Perc Pineda, PhD

Chief Economist, PLASTICS

July 28, 2025

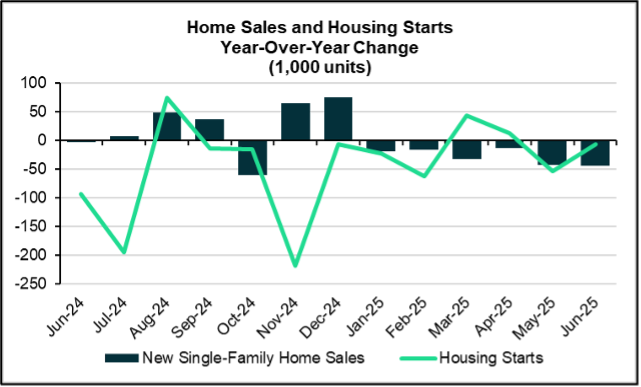

The housing market’s persistent weakness, marked by declining housing starts and sluggish new single-family home sales, continues to cast a shadow over industrial production, particularly in the plastics manufacturing sector. This downturn creates a ripple effect, not only curbing demand for construction supplies but also dampening consumer spending on plastic-intensive household goods.

Housing Market Trends

In June 2024, new single-family home sales showed a modest uptick, rising by 4,000 units on an annualized basis. This marked an improvement from the significant 82,000-unit drop in May. However, compared just one year before, sales were down by 44,000 units, a 6.6% year-over-year decline. Similarly, housing starts rebounded slightly, increasing by 58,000 units in June after a 135,000-unit decrease in May. This represents a 4.6% month-over-month increase but a 0.5% or a 6,000 units year-over-year decline.

These lackluster figures reflect ongoing challenges in the housing sector, worsened by persistently high mortgage rates. While rates have eased from a peak of 7.0% on January 16, 2024, they remain elevated at 6.7% as of July 24, 2024—1.8 percentage points higher than the 4.9% recorded on November 15, 2018, the highest pre-COVID rate. All eyes are on the Federal Reserve to see if and when it will cut rates to stimulate growth. Lower rates could reduce the 10-year Treasury yield—a key benchmark for 30-year fixed mortgage rates—which has stayed above 4.0% since October 16, 2024.

Impact on Construction Supplies and Plastics

The slowdown in housing activity directly affects the production of construction supplies, which is closely tied to plastics manufacturing. According to the 2024 Size and Impact Report of the plastics industry, 8.7% of final plastic products were used in the construction industry. Materials such as siding, vapor barriers, piping, cables, insulation, and vinyl flooring rely heavily on plastics, and reduced housing starts translate into lower demand for these products. The latest estimate of the share of plastics going into construction will be available in PLASTICS ‘forthcoming 2025 Size and Impact Report, to be released on September 16, 2025. Visit www.plasticsindustry.org for more information.

The Industrial Production Index for construction supplies manufacturing, which correlates strongly with plastics shipments, showed mixed performance in 2024. Production increased by 2.8% from January to March but declined by 1.1% in April before a modest 0.4% rise in June. These fluctuations underscore the housing market’s drag on industrial output.

Broader Implications for Plastics Demand

Beyond construction materials, the housing market’s weakness indirectly curbs plastics demand through reduced consumer spending on household goods. Lower home sales lead to decreased purchases of housewares and appliances, both of which incorporate significant amounts of plastic components. This creates a broader restraint on plastics consumption, as the residential real estate market’s softness has rippled through related industries.

Looking Ahead

The interplay between housing market dynamics and plastics manufacturing highlights the broader economic implications of residential real estate trends. With mortgage rates remaining elevated and housing starts and sales struggling to gain momentum, the plastics industry faces ongoing challenges in the construction sector. Stakeholders in housing and plastics manufacturing must navigate these challenges carefully, as a housing market recovery is vital to increasing demand for plastics and overall related products.