U.S. trade policy toward Central America has historically emphasized market access and tariff liberalization through regional free trade agreements. Despite this framework, the United States imposed reciprocal tariffs on El Salvador and Guatemala, even though both countries are covered under CAFTA-DR (the Dominican Republic–Central America–United States Free Trade Agreement). The tariffs did not apply to the other CAFTA-DR partners—Costa Rica, Honduras, Nicaragua, and the Dominican Republic. Effective August 7, 2025, a 10% reciprocal tariff on imports from El Salvador and Guatemala was implemented, while other CAFTA-DR partners remained exempt. Trade data show that CAFTA-DR partners overall, as well as El Salvador and Guatemala individually, generated trade surpluses in U.S. plastics trade.

Implications for the U.S. Plastics Industry

U.S. trade with CAFTA-DR partners has been robust over the years. U.S. plastics industry exports—consisting of resins, plastics machinery, molds for plastics, and plastic products—have grown strongly. In 2024, exports totaled $2,544.4 million, while imports totaled $580.5 million, generating a trade surplus of $1,963.9 million. Since the creation of the free trade agreement in 2004, U.S. plastics exports to CAFTA-DR partners increased at a 5.3% compound annual growth rate (CAGR), while imports rose at a 6.0% CAGR. Since 2014, the U.S. plastics trade surplus with CAFTA-DR partners has expanded at a 5.2% CAGR.

The impact of the 2025 reciprocal tariffs can be assessed through bilateral trade flows. In 2024, U.S. plastics exports to El Salvador and Guatemala totaled $574.6 million, accounting for 22.6% of total U.S. plastics exports to CAFTA-DR countries. Of this amount, $140.9 million went to El Salvador and $433.7 million to Guatemala. During the same period, U.S. plastics imports totaled $26.2 million from El Salvador and $37.0 million from Guatemala. Overall, the United States recorded a $511.5 million plastics trade surplus with these two countries.

U.S. Agreements with El Salvador and Guatemala

As the United States began talks with trade partners last year following the imposition of reciprocal tariffs, negotiations with free trade partners included restoring tariffs to the zero rate.*

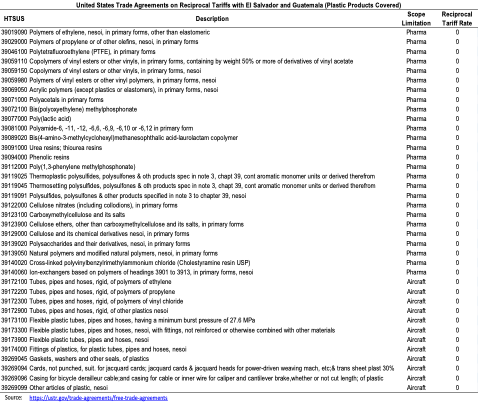

Last month, the United States signed trade agreements with El Salvador and Guatemala on reciprocal trade. However, with a caveat. The trade agreements with each country reinforced the 10% reciprocal tariff rate, but provided exceptions based on scope and limitations of the imports. As far as plastics are concerned, 38 plastic materials, resins, and products have been brought back to the CAFTA-DR zero tariff baseline. All other products are subject to reciprocal tariffs of 10%. There is, however, a caveat. The agreements between the U.S. and these two countries specify which plastics qualify for the zero rate. As shown in the tables below, the column “Scope Limitations” specifies the exact, specific, category of imports – either “Pharma” or “Aircraft.” In other words, plastics imported from El Salvador and Guatemala for pharmaceuticals and aircraft-related uses will be duty-free. The agreements cover the same plastics and plastic products originating for El Salvador and Guatemala as indicated in the table.

Trade Surplus Masks Strategic Supply-Chain Exposure

The United States has ample capacity to produce the plastics materials, resins, and products covered under the trade agreements with El Salvador and Guatemala and, by extension, export them globally. Based on estimates using six-digit HTS categories derived from the table below, U.S. exports of these plastics totaled approximately $19.2 billion in 2024, while imports reached $17.8 billion, yielding a trade surplus of $1.4 billion. Despite this surplus, 27% of total U.S. imports of these products originated from China—a notable share given that the combined imports from Mexico and Canada accounted for 24% (13% from Mexico and 11% from Canada). For pharmaceutical and aircraft applications, reorienting supply chains closer to the United States—beyond Mexico and Canada—appears both economically and strategically justified, aligning with broader near-shoring efforts and national security considerations.

Viewed in a broader context, recent adjustments in U.S. trade and tariff policy with Central America appear to reflect an evolution rather than a break from established trade practices. Beyond supporting domestic manufacturing, the targeted use of reciprocal tariffs—alongside narrowly defined exemptions for pharmaceutical and aircraft-related plastics—points to an effort to balance trade openness with supply-chain reliability and operational resilience. Even as the United States continues to post strong plastics trade surpluses with CAFTA-DR partners, these measures suggest a pragmatic approach to managing exposure, reinforcing regional production networks, and maintaining dependable access to critical inputs. Taken together, the policy framework remains consistent with longstanding cooperative trade relationships while adapting to changing economic and industrial conditions.

* The full text of the Trade Agreements on El Salvador and Guatemala can be found at https://ustr.gov/trade-agreements/free-trade-agreements