Perc Pineda, PhD

Chief Economist

In the plastics manufacturing industry, at least 50% of total costs are materials—primarily plastic resins—while the remainder is allocated across labor and other operating expenses. According to PLASTICS’ 2025 Size and Impact Report, materials accounted for 66.6% of shipments, annual payroll represented 12.7%, and the remaining 20.7% reflected other operating costs. Changes in the broader economic environment can affect both materials and labor costs, altering their shares of total shipments over time.

Cooler labor market, rising labor costs

How the labor market will evolve in 2026 remains uncertain, but conditions are expected to cool over the year. Total nonfarm job openings have been declining, and employment growth has flattened. While the unemployment rate is projected to remain below 5.0%, labor costs are nevertheless expected to continue rising.

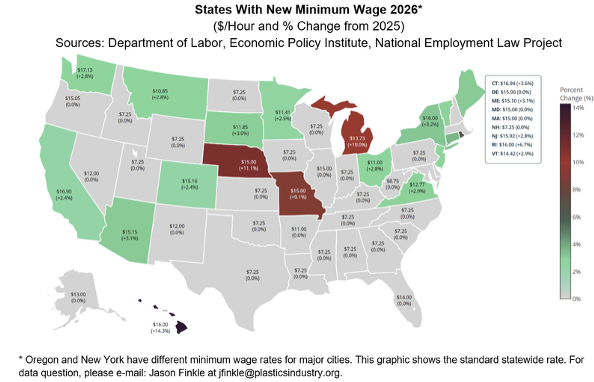

Average wages in U.S. plastics manufacturing remain well above the minimum wage; however, several states have enacted minimum wage increases effective in 2026 (see map below). For businesses operating in these states, labor costs will increase. As shown in the map, three of the top states for plastics employment (see Size and Impact Report 2025). Additionally, three states (Alaska, Florida, and Oregon) are expected to increase their minimum wages later this year.

How minimum wage ripples through wages

One contributing factor is wage compression, an economic phenomenon in which increases in the statutory minimum wage prompt upward adjustments in wages above the minimum, narrowing pay differentials at the lower end of the wage distribution as employers seek to preserve internal wage structures and employee morale. These adjustments carry direct cost implications.

Minimum wage increases can also generate wage spillover (or ripple) effects, whereby higher mandated wage floors lead to wage gains for workers earning above the minimum, extending the policy’s impact beyond directly affected minimum-wage earners.

Employment costs and benefits: Insights from ECI

In recent years, employment costs, as measured by the Employment Cost Index (ECI), have fluctuated. The ECI, produced quarterly by the U.S. Bureau of Labor Statistics, tracks changes over time in employers’ costs for wages, salaries, and employee benefits. The index is designed to isolate compensation changes from shifts in employment composition, making it a key indicator of underlying labor cost pressures. Unlike average hourly earnings, which can be affected by changes in the mix of jobs (for example, laying off lower-wage workers or hiring higher-wage workers), the ECI captures true changes in compensation.

In the second quarter of 2022, the ECI recorded its largest year-over-year increase at 5.0% before moderating to 3.2% in the first quarter of 2025, and then rising slightly to 3.3% and 3.4% in the second and third quarters, respectively. It is likely that the fourth-quarter ECI exceeded 3.0%. Looking ahead, plastics manufacturers should factor in a potential ECI increase above 3.0% in 2026.

The ECI captures total employer compensation, including both wages and benefits. The benefits component includes paid leave, retirement contributions, and health insurance, among other items. Health insurance costs, in particular, can significantly influence overall labor costs, as they are affected by broader healthcare spending trends and government policies. Changes in public healthcare programs or regulations may lead to higher premiums for employer-sponsored plans, which are reflected in the ECI as part of rising non-wage compensation. As such, the ECI provides a comprehensive measure of labor cost pressures, capturing not only wage growth but also the impact of benefits that are sensitive to policy and economic developments.

For the year ahead, plastics manufacturers will need to carefully monitor both wage trends and employment cost dynamics. Minimum wage increases, wage compression, and ripple effects, combined with rising benefit costs—particularly health insurance influenced by broader policy and regulatory changes—are likely to place upward pressure on total labor costs in 2026. By understanding these forces and incorporating projected changes in the ECI into budgeting and strategic planning, businesses can better anticipate cost pressures, maintain competitiveness, and sustain workforce stability in an evolving labor market.