Perc Pineda, PhD

Chief Economist, PLASTICS

The U.S. labor market outperformed expectations in March, adding 303K nonfarm payrolls, demonstrating resilience despite a high-interest-rate environment. The unemployment rate remained low at 3.8%, with certain sectors reporting even lower rates. For instance, the manufacturing industry saw a 3.0% unemployment rate, while the plastics and rubber products manufacturing sector reported a mere 2.1% unemployment rate. It is worth noting, however, that despite these low unemployment rates, the plastics and rubber products manufacturing sector experienced a decrease in payrolls of 1.1K during the same period.

However, a detailed analysis of the March jobs data from the Bureau of Labor Statistics reveals some concerns. It is well-known that the U.S. is a services-based economy, encompassing diverse sectors such as finance, healthcare, education, and retail, among others. Notably, consumption of services in the U.S. surpasses that of goods. For instance, in February, 66.0% of the $15.7 trillion inflation-adjusted Personal Consumption Expenditures (PCE) were attributed to services consumption, with the remaining 34.0% allocated to goods consumption. This distribution of PCE would naturally be expected to have implications for the composition of the economy’s labor market.

Goods-producing sector trails services-providing sector

62.7% of the total nonfarm payrolls in March were contributed by the private services-providing sector, with an additional 190K jobs added following a similar increase in February. The goods-producing sector, which includes mining and logging, construction, and manufacturing, saw a notable increase of 42K payrolls in March, driven mainly by a 39K increase in construction, building upon the 17K gains from February. However, the manufacturing sector remained stagnant, with no change in March after a 10K decrease in February. Consequently, the goods-producing sector’s share of the total increase in nonfarm payrolls in March stood at 13.9%. While private sector job additions exhibited a clear divide, the public sector outpaced the goods-producing sector in job creation. Government jobs, estimated at 71K, accounted for 23.4% of the total nonfarm payrolls added in March.

Services and government take the lead in U.S. labor market

A year ago, 37.7% of the added jobs were in the government, while 70.5% were in the services sector, underscoring their dominance in job growth. This indicates a -8.2% share of job growth for the goods-producing sector. Despite efforts by the U.S. government to revitalize American manufacturing1, data suggests that the manufacturing sector still faces significant challenges.

Why is manufacturing not contributing to job growth? It is not merely due to weak labor demand; rather, it is primarily a labor supply issue.

Unfilled manufacturing jobs

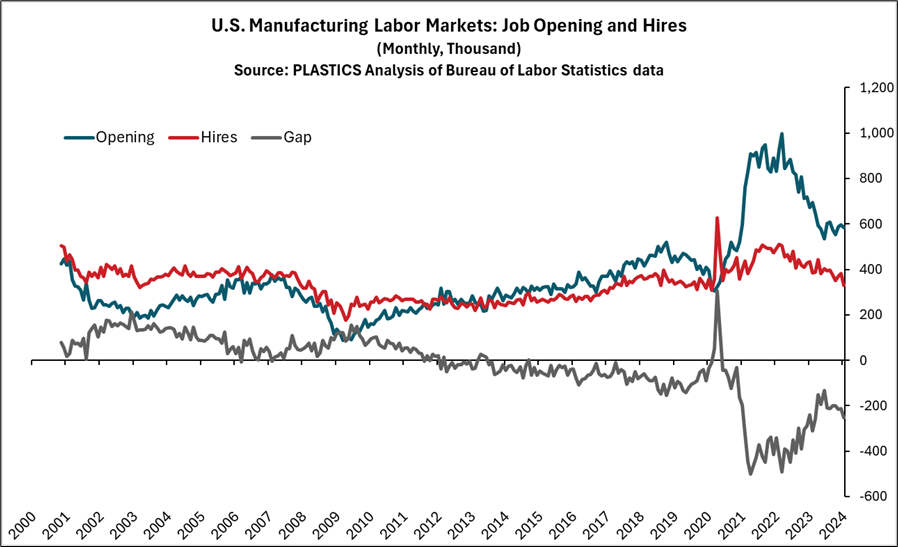

As depicted in the chart, the dynamics between job openings and hires in manufacturing have shifted over time. Previously, the number of hires in manufacturing exceeded job openings, signaling expansion in the economy’s manufacturing sector, based on data from 2001. However, this trend reversed starting in the Summer of 2013 and persisted, except for a brief period in April, May, and June of 2020 during the COVID-19 lockdowns. The gap between openings and hires in manufacturing continued to widen after the lockdowns and reached its widest point in April 2022, with nearly half (45.1%) of the 997K openings remaining unfilled. Although the opening and hiring gap has since narrowed, February still saw 253K unfilled manufacturing jobs.

The persistent gap between job openings and hires in manufacturing is likely to continue due to the current low labor supply. This gap is exacerbated by the reluctance of young workers, including new labor market entrants, to pursue employment in the manufacturing sector, despite competitive wages. The preference for service jobs over manufacturing roles underscores the urgent need for comprehensive policy interventions aimed at increasing the manufacturing labor supply.

Any government initiative aimed at revitalizing the manufacturing sector and enhancing American competitiveness on the global stage must proactively address these underlying issues. This could involve targeted strategies such as incentivizing vocational training programs, fostering partnerships between educational institutions and manufacturing companies, and implementing measures to make manufacturing careers more attractive to younger generations.

1. The White House. “The Biden-Harris Plan to Revitalize American Manufacturing and Secure Critical Supply Chain in 2022” February 24, 2022. https://www.whitehouse.gov/briefing-room/statements-releases/2022/02/24/the-biden-harris-plan-to-revitalize-american-manufacturing-and-secure-critical-supply-chains-in-2022/