Perc Pineda, PhD

Chief Economist, PLASTICS

Tariffs and trade remain central concerns for many businesses today. While the situation continues to evolve and will eventually be addressed through negotiations with U.S. trade partners, the impact of tariffs and trade policies varies depending on a company’s business model—particularly its reliance on imports, position within the supply chain, and industry exposure to global markets.

For example, the U.S. plastics industry trade exposure was approximately 20% in 2023, though this varies by sector. Resin, in particular, had significant trade activity: U.S. exports accounted for 43.7% of domestic shipments, while imports were 18.9%.

Bioplastics trade volume increased but deficit remains

Trade in bioplastics—including biopolymers and natural polymers—increased in 2024, based on preliminary data from the U.S. International Trade Commission. Trade volume rose 6.2% to $990.5 million. Exports grew 10.7% to $494.8 million, up from $446.8 million in 2023, while imports rose 2.0% to $495.7 million. As a result, the U.S. trade deficit in bioplastics narrowed significantly, from $39.3 million in 2023 to just $833.1 thousand in 2024.

The 10.7% increase in U.S. bioplastics exports was the fastest annual gain in the past decade. This follows a 22.0% drop in 2023, likely driven by declining global prices as pandemic-related supply chain disruptions eased. The rebound in 2024 suggests a renewed momentum in investment, as the bioplastics industry—characterized by capital-intensive research and development and the need to scale production—continued to expand to meet return-on-investment targets.

Investment spending in bioplastics growing

Industry observers have noted a steady rise in investment and planned spending in bioplastics manufacturing. According to i3 Connect data reported by the Associated Press (Gillispie, 2022), investment in bioplastics reached $500 million in the first quarter of 2022—surpassing the previous high of $350 million recorded in the fourth quarter of 2021.

More recently, in June 2024, the Southwest Indiana Development Council reported that AgroRenew announced plans to build an $83 million processing facility in Knox County, Indiana. The facility will focus on producing biodegradable and sustainable plastics derived from agricultural waste.

Given the rise in trade and increased investment activity, it is reasonable to expect that bioplastics manufacturing output will continue to grow—driven in large part by consumer demand for biodegradable and compostable plastics. Beyond their environmentally sustainable footprint, bioplastics also contribute to broader economic output and employment impact that extend well beyond the sector itself.

Methodology, assumptions, and results

As noted above, resin exports accounted for 43.7% of domestic shipments in 2023. Applying the same ratio, the $446.8 million in bioplastics exports that year implies approximately $1.002 billion in domestic shipments. For simplicity, we assume that bioplastics manufacturing output increased by $1 billion in 2023. Using the IMPLAN model—an input-output framework based on a social accounting matrix that captures all economic flows—we estimate the direct, indirect, and induced effects of this increase in bioplastics manufacturing output.

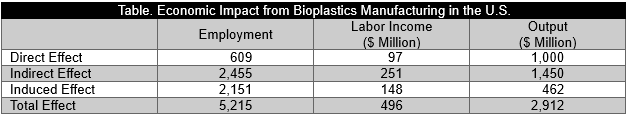

[The direct effects of the bioplastics industry include the jobs, wages, and output generated by companies that produce bioplastic materials. Indirect effects arise from the industry’s purchases of goods and services from suppliers — such as equipment manufacturers, transportation providers, and utility companies. Meanwhile, induced effects reflect the household spending of workers employed both directly and indirectly, which supports jobs in sectors like retail, healthcare, and housing.]

The output and employment generated by bioplastics manufacturing are substantial. According to IMPLAN simulation results, an additional $1 billion in bioplastics manufacturing output could generate a total of $2.9 billion in economic output and support 5,215 jobs across the U.S. economy. The table below summarizes the simulation results.

In addition to the 609 direct jobs in bioplastics manufacturing, supply chain activities would generate an estimated 2,455 indirect jobs in other sectors. Furthermore, the wages earned by workers in both direct and indirect businesses support consumer spending that results in 2,151 induced jobs throughout the broader economy.

In sum, every $1 billion increase in bioplastics output is associated with a total economic impact of $2.9 billion and supports 5,215 jobs, along with $496 million in labor income — all expressed in 2025 dollars.