Perc Pineda, PhD

Chief Economist, PLASTICS

August 14, 2025

The July 2025 jobs report from the Bureau of Labor Statistics (BLS) has been overshadowed by news of the BLS Director’s firing, with political commentators quick to weigh in. However, for industries such as plastics and rubber products manufacturing, the report offers critical insights into labor market trends, economic momentum, and their implications for business strategy. By examining key metrics—unemployment rates, nonfarm jobs added, and labor productivity—we can better understand the health of the U.S. economy and its specific impact on the plastics sector.

A Resilient Labor Market: Unemployment Rates in Focus

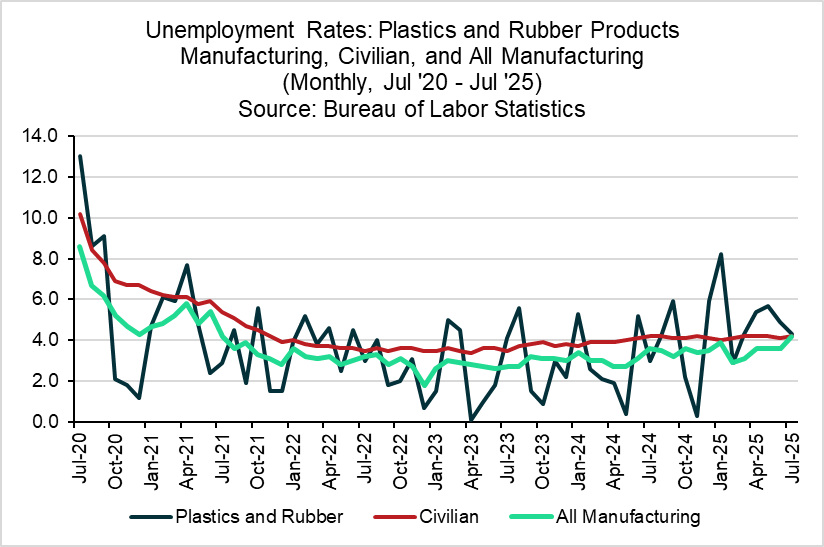

The July jobs report underscores the continued strength of the U.S. labor market, with the unemployment rate holding steady at 4.2%. Because monthly data can be noisy, looking at longer time frame reveals the underlying trend. Over the past 12 months, the rate has fluctuated within a narrow range—reaching 4.1% in five months and dipping to 4.0% in one. This stability suggests that while the labor market remains robust, unemployment could move above or below its recent 12-month high, calling for careful monitoring.

In manufacturing, the unemployment rate matched the broader economy at 4.2% in July, consistent with its trend of staying below the civilian unemployment rate over the past five years. Within the plastics and rubber products manufacturing sector, unemployment was slightly higher at 4.3%, down from previous months. This volatility in the plastics sector, compared to overall manufacturing, reflects its sensitivity to economic shifts, as illustrated in historical BLS data trends.

Nonfarm Jobs Added: A Forward-Looking Perspective

While the unemployment rate provides a snapshot of labor market health, nonfarm jobs added offers a more dynamic view of economic momentum. In July, the economy added 73,000 private nonfarm jobs, a positive figure indicating continued business expansion. However, the magnitude of job growth matters—73,000 jobs suggest cautious optimism rather than robust confidence, especially when paired with downward revisions to prior months. May and June job gains were revised down by 19,000 and 14,000, respectively, resulting in a second-quarter total of 191,000 jobs being added, a sharp decline from the 333,000 added in the first quarter. For the first seven months of 2025, private nonfarm payrolls grew by 597,000.

In the plastics and rubber products manufacturing sector, July saw a modest gain of 300 jobs, contrasting with a loss of 11,000 jobs in the broader nondurable goods manufacturing sector. However, the BLS estimates that plastics and rubber products manufacturing lost 2,700 jobs over the first seven months of 2025. These figures, while lagging indicators, confirm a cooling labor market and highlight the plastics sector’s volatile job creation, mirroring the broader economy’s slowdown. With the economy near full employment, as evidenced by the 4.2% unemployment rate, slower job growth is expected, especially as rising productivity reduces the need for additional workers, consistent with the Law of Diminishing Returns.

Rising Labor Productivity: A Key Driver

The BLS productivity report released on August 7, 2025, provides context for these trends. Non-farm business labor productivity—output per hour worked—rose 2.4% in the second quarter, driven by a 3.7% increase in output and a 1.3% rise in hours worked. Compared to the second quarter of 2024, productivity grew by 1.3%. This rise in productivity suggests businesses are generating more output without proportionally increasing labor inputs, which may explain the slowdown in job creation.

The Law of Diminishing Returns, a fundamental economic principle, explains this dynamic. It states that adding more of one input, such as labor, while keeping other inputs like capital fixed, eventually results in smaller output gains. For example, business investment in structures continued its decline for the second consecutive quarter, down 10.3% in Q2 2025, limiting the capital available to complement labor. Hiring additional workers may not be necessary to sustain output growth as firms are likely to rely on technology or process improvements to boost efficiency rather than expanding payrolls. Policy considerations could also play a role here. Higher borrowing costs constrain capital investment, limiting firms’ ability to upgrade equipment or facilities. Additionally, increased tariffs could raise the cost of capital spending, further discouraging investments that could enhance productivity and offset diminishing returns.